Phoenix, Arizona--(Newsfile Corp. - February 5, 2026) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") announces that on February 4, 2026, Greenstone Resources II LP ("Greenstone") together with its affiliates Greenstone Excelsior Holdings LP, Greenstone Co-Investment No 1 (Excelsior) LP and Greenstone Co-Investment No 2 (Excelsior) LP (together, the "Greenstone Group"), entered into an agreement (the "Agreement") with Paradigm Capital Inc ("Paradigm") pursuant to which the Greenstone Group appointed Paradigm to act as agent on a commercially reasonable "best efforts" basis, in connection with an offering to institutional investors of up to 143,208,937 common shares (the "Shares") of Gunnison Copper Corp. ("Gunnison") currently owned by the Greenstone Group (the "Offering").

Completion of the Offering will be subject to execution by the Greenstone Group and the Purchasers of share purchase agreements. Completion of the Offering is expected to occur on or by 17 February, 2026.

As Greenstone's fund approaches the end of its investment lifecycle and begins to sunset, the transfer of Shares is a normal and orderly process. Gunnison remains grateful for Greenstone's long-term support and looks forward to continuing to build value for its expanding institutional shareholder base.

"On behalf of Gunnison, I would like to express our sincere gratitude to Greenstone Resources L.P. for being a valued and supportive partner over the last 10+ years," said Stephen Twyerould, President and CEO of Gunnison Copper. "Greenstone has played an important role in the Company's growth and advancement, and we deeply appreciate their long-standing commitment and contribution to our progress."

The Greenstone Group beneficially owns and controls 143,208,937 common shares of Gunnison, representing an aggregate ownership interest in Gunnison of 33.88% (excluding conversion or exercise of debentures and options of Gunnison owned by the Greenstone Group and which do not form part of the Offering).

Following completion of the Offering, the Greenstone Group will no longer own any common shares of Gunnison, representing a decrease in ownership of 33.88%.

ABOUT GUNNISON COPPER

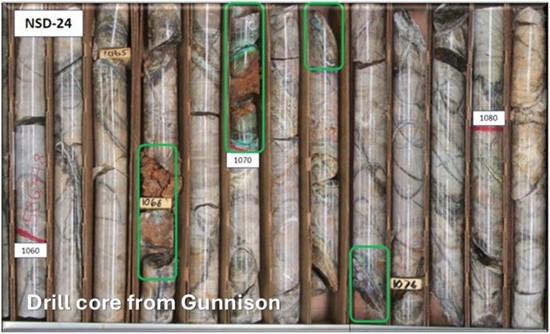

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024, and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; the completion of the Offering; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company's operational plans, expectations regarding the receipt of 48C tax credits, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, the Company receives less 48C tax credits than expected, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282806

Phoenix, Arizona--(Newsfile Corp. - January 20, 2026) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") is pleased to announce it has fully eliminated all outstanding principal owed to Nebari Natural Resources Credit Fund I LP ("Nebari"), marking a significant milestone in the Company's transformation of its balance sheet.

In total, Gunnison has reduced the principal amount of the Nebari debt from US$15.0 million to zero, achieving its stated objective of removing legacy secured debt and materially strengthening the Company's financial position. This achievement is consistent with Gunnison's broader strategy to maintain an equity-based capital structure until the construction of its flagship Gunnison Project.

The debt was finally eliminated when the Company received additional conversion notices from Nebari pursuant to the terms of the Second Amended and Restated Credit Agreement (the "Second ARCA"). The latest conversions total US$4.75 million at a conversion price of US$0.2097 per share (converted from C$0.30), resulting in the issuance of 22,651,407 common shares.

"The repayment of the Nebari debt is a major milestone for Gunnison," said Craig Hallworth, SVP & CFO of Gunnison Copper. "Through disciplined execution, delivery on key milestones, and strategic conversions, we have removed all legacy secured debt from our capital structure. This significantly strengthens our balance sheet and positions Gunnison with enhanced financial flexibility as we continue to execute on major milestones in the advancement of our large-scale flagship Gunnison Project. As a pure-play copper company, we are proud to be advancing new large-scale copper production on US soil, as demand continues to grow from national defense, infrastructure, and AI data centers."

Andre Krol of Nebari commented, "Nebari's debt conversions are testament to the Company's strengthening progress under highly capable management. We are proud to have been part of that journey."

Combined with Gunnison's previously announced US$7.3 million repayment of Nebari's non-convertible debt, and Nebari's accumulated conversions of the remaining convertible principal, all principal amount outstanding under the Second ARCA have now been fully repaid or converted. Gunnison shall repay the partial month of interest owing and is working with Nebari to obtain a release of the security documents associated with the debt.

Gunnison remains focused on operational execution, balance-sheet strength, and delivering long-term value as it supports domestic copper supply and U.S. critical-minerals objectives.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company's operational plans, expectations regarding the receipt of 48C tax credits, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, the Company receives less 48C tax credits than expected, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280923

Phoenix, Arizona--(Newsfile Corp. - January 15, 2026) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") announces Rio Tinto's strategic collaboration with Amazon Web Services (AWS) that will see AWS become Nuton® Technology's first customer following the breakthrough first industrial-scale deployment of the innovative bioleaching technology at Gunnison's Johnson Camp copper mine in the U.S. last month.

Under the agreement, AWS will use the first Nuton copper ever produced in components of its U.S. data centres, while also providing cloud-based data and analytics support to accelerate the optimisation of Nuton's proprietary bioleaching technology at Gunnison Copper's Johnson Camp Mine. Data centres use copper in a wide variety of applications, including electrical cables and busbars, windings in transformers and motors, printed circuit boards, and heat sinks on processors.

Nuton also utilises AWS platforms to simulate heap-leach performance and feed advanced analytics into Nuton's decision systems, allowing for optimised acid and water use while improving predictions for copper recovery.

Nuton's modular bioleaching system works by extracting copper from primary sulphide material using naturally occurring microorganisms. This modular approach, combined with digital tools, enables rapid scaling and tailoring of the technology to different mineralized material bodies, reducing the pathway from concept to production.

The process produces 99.99% pure copper cathode at the mine gate and removes the need for traditional concentrators, smelters and refineries, significantly shortening the mine-to-market supply chain. Nuton is projected to use substantially less water and have lower carbon emissions compared with conventional concentrator processing routes, while also recovering value from material previously classified as waste.

Rio Tinto Copper Chief Executive Katie Jackson said: "This collaboration is a powerful example of how industrial innovation and cloud technology can combine to deliver cleaner, lower-carbon materials at scale. Nuton has already proven its ability to rapidly move from idea to industrial production, and AWS's data and analytics expertise will help us to accelerate optimisation and verification across operations."

"Importantly, by bringing Nuton copper into AWS's U.S. data-centre supply chain, we're helping to strengthen domestic resilience and secure the critical materials those facilities need, closer to where they're used. Together we can supply the copper critical to modern data infrastructure while demonstrating how mining can contribute to more sustainable supply chains."

Amazon's Chief Sustainability Officer Kara Hurst said: "Amazon's Climate Pledge goal to reach net zero carbon by 2040 requires us to innovate across every part of our operations, including how we source the materials that power our infrastructure."

"This collaboration with Nuton Technology represents exactly the kind of breakthrough we need—a fundamentally different approach to copper production that helps reduce carbon emissions and water use. As we continue to invest in next-generation carbon-free energy technology and expand our data center operations, securing access to lower-carbon materials produced close to home strengthens both our supply chain resilience and our ability to decarbonize at scale."

Gunnison Copper's Chief Executive Officer and President Stephen Twyerould said: "Having the first Nuton copper produced from Johnson Camp used in AWS's U.S. data centres is a significant milestone for this innovative technology's ability to deliver lower-carbon, domestically produced and used copper. This collaboration highlights how innovation, digital optimisation, and Made-in-America copper production can strengthen U.S. supply chains, while supporting the growing demand for critical minerals powering modern infrastructure."

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024, and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; the goal of being debt free in 2026; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, Nebari will convert the remaining principal amount of the Second ARCA, the availability of financing to continue as a going concern and implement the Company's operational plans, expectations regarding the receipt of 48C tax credits, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nebari not converting the remaining principal amount of the Second ARCA and the Company not having sufficient funds to repay such amount, the Company receives less 48C tax credits than expected, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280417

Collaboration to Explore Arizona's Cochise Mining District for Critical Minerals with Advanced Airborne Georadiotomography (aGRT) Technology

Phoenix, Arizona--(Newsfile Corp. - December 19, 2025) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") is pleased to announce that it has entered into a Collaboration Framework Agreement ("CFA") with Lunasonde Inc. ("Lunasonde"), a defense and mineral exploration technology company focused on next-generation subsurface remote sensing using Airborne Georadiotomography (aGRT) Technology.

Under the agreement, Lunasonde will deploy its proprietary remote sensing technology to conduct an initial high-resolution subsurface survey over a defined portion of Gunnison's mineral property portfolio within the Company's Cochise Mining District in southern Arizona. The work program is expected to include test and calibration flights, followed by data processing and analysis to generate three-dimensional subsurface imaging of identified anomalies with the potential to host critical minerals.

The collaboration is intended to evaluate the potential application of Lunasonde's technology as a complementary exploration and targeting tool across Gunnison's land position, which hosts multiple known copper deposits within close proximity to existing infrastructure and operations.

"This collaboration reflects Gunnison's disciplined approach to innovation and data-driven decision-making," said Stephen Twyerould, President & CEO of Gunnison Copper. "We are continuously evaluating advanced technologies that have the potential to enhance our geological understanding, improve targeting efficiency, and support long-term value creation across the Cochise Mining District."

"Our partnership with Gunnison is a pivotal first step towards deploying aGRT for mineral exploration across the globe and securing our nation's critical mineral supply" said Jeremiah Pate, Founder and CTO of Lunasonde.

Lunasonde's technology is designed to identify subsurface features from aerial and space-based platforms, offering a non-invasive method of data acquisition that may complement traditional geophysical and geological datasets. Results from the initial survey will be assessed alongside Gunnison's existing technical information to determine potential future applications.

The Company also announces that it has received a third conversion notice from Nebari Natural Resources Credit Fund I LP ("Nebari") pursuant to the terms of the Second Amended and Restated Credit Agreement (the "Second ARCA"). See the Company's press release dated April 24, 2025 for further details of the Second ARCA. The conversion benefits the Company as it reduces the principal amount of the Second ARCA. With a full conversion of the convertible principal amount by Nebari, and the intention to use the proceeds to be received from sale of the previously announced 48C tax credits to repay the remaining convertible portion of the Second ARCA, the Second ARCA could be repaid in full.

The third conversion is for US$500,000 at the conversion price of US$0.2097 (converted from C$0.30), resulting in the issuance of 2,384,358 common shares. Nebari have advised that they are converting for the purpose of sale and may convert further amounts.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT LUNASONDE

Lunasonde Inc. is a defense and mineral exploration technology startup dedicated to revolutionizing subsurface sensing using its novel radar system capable of discerning underground features from aerial and space platforms. Their mission is to address the scarcity of critical minerals and life-sustaining natural resources by delivering rapid, high-resolution subsurface data via aerial radar combined with advanced processing pipelines. The company's solutions support commercial, defense, and humanitarian applications-enabling resource mapping, recurring monitoring, and exploration in environmentally sensitive or politically challenging areas on Earth, and, ultimately, celestial bodies.

For more information, please visit www.lunasonde.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; plans to fully retire the remaining Nebari debt; the terms and benefits of the transaction with Lunasonde; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, Nebari will convert the remaining principal amount of the Second ARCA, the availability of financing to continue as a going concern and implement the Company's operational plans, expectations regarding the receipt of 48C tax credits, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nebari not converting the remaining principal amount of the Second ARCA and the Company not having sufficient funds to repay such amount, the Company receives less 48C tax credits than expected, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278649

Phoenix, Arizona--(Newsfile Corp. - December 4, 2025) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") announces that Rio Tinto has successfully produced the first copper from the Johnson Camp mine in Arizona using its Nuton® Technology, marking a pivotal step forward in the development of this innovative copper processing technology.

After more than 30 years of research and development, the first copper cathode using Rio Tinto's proprietary bioleaching technology, which relies on microorganisms grown on site, was produced at Gunnison Copper's Johnson Camp mine last month. The deployment involves the design and delivery of a technology package for a heap leach pad targeting production of approximately 30,0001 tonnes of refined copper over a four-year demonstration period. Rio Tinto is engaging with several potential customers in the U.S. to support the domestic copper supply chain.

Rio Tinto Copper Chief Executive Katie Jackson said, "This is a breakthrough achievement for our Nuton technology, which is proving that cleaner, faster, and more efficient copper production is possible at an industrial scale. In an industry where projects typically take about 18 years to move from concept to production, Nuton has now proven its ability to do this in just 18 months.

"Nuton has designed a modular system deployed as a technology package integrating biology, chemistry, engineering, and digital tools, allowing it to be rapidly scaled and tailored to different ore bodies, unlocking resources that have historically been considered uneconomic or challenging. We are actively partnering on projects in North and South America to assess the potential for future deployment at additional sites in the coming years."

Nuton relies on naturally occurring microorganisms to extract copper from primary sulphide materials, which are traditionally difficult to process. These microbes, grown at large scale in Nuton's proprietary bioreactors, accelerate the oxidation of minerals in the crushed material heap, generating heat and enabling copper to dissolve into a leach solution, which is then processed into 99.99% pure copper cathode.

Significantly, processing copper material with Nuton eliminates the need for concentration, smelting and refining, shortening supply chains and delivering copper cathode at the mine gate. It achieves recovery rates of up to 85% from primary sulphides, the most abundant copper bearing materials in the world.

Nuton can also extend mine life and maximize resource use by extracting value from mineralized materials that would otherwise be classified as waste, increasing yield and revenue at both new and existing mines. Its environmental performance is expected to exceed conventional copper processing technologies, with up to 80% less water usage and up to 60% lower carbon emissions than the traditional concentrator route.

At Johnson Camp, Nuton aims to produce copper with the lowest carbon footprint in the U.S. Through the purchase of 134,000 Green-e Energy certified renewable energy certificates, Nuton ensures 100% of the site's electricity is matched by renewable sources. The copper produced is anticipated to have a mine-to-metal carbon footprint of 0.82-kilogram CO₂-e per kilogram copper, the lowest in the U.S. and substantially lower than the projected 2026 global average of 3.4 kilograms CO₂-e per kilogram among operating copper mines. Additionally, water intensity is anticipated to be 71 litres per kilogram copper, compared to the global average industry estimate of ~130 litres per kilogram of copper production2.

Gunnison Copper Chief Executive Officer and President Stephen Twyerould said, "The first production of Nuton copper at Johnson Camp is the culmination of exceptional teamwork between Gunnison Copper and Rio Tinto's Nuton team. Achieving this level of performance in such a short time frame shows what is possible when innovation, operational excellence, and a shared vision come together. With Nuton copper now entering the U.S. supply chain, this milestone underscores the critical role we can play in strengthening domestic access to cleaner, low-carbon copper."

While this milestone confirms Nuton's engineering and operational viability, the next phase will focus on validating long-term technical performance. This includes multi-year testing, independent third-party verification, and internal review by Rio Tinto to ensure consistent recovery rates and environmental performance.

1 Includes ~16kt from run of mine leaching pad and ~14kt from Nuton technology.

2 Water and carbon emissions intensities for Johnson Camp and global averages have been validated by Skarn Associates, a leading provider of carbon and water intensity curves for the industry.

Contacts

Please direct all enquiries to

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, Nebari will convert the remaining principal amount of the Second ARCA, the availability of financing to continue as a going concern and implement the Company's operational plans, expectations regarding the receipt of 48C tax credits, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nebari not converting the remaining principal amount of the Second ARCA and the Company not having sufficient funds to repay such amount, the Company receives less 48C tax credits than expected, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276917

Major Deleveraging Milestone Achieved as Company Moves to Fully Eliminate Nebari Debt

Phoenix, Arizona--(Newsfile Corp. - December 1, 2025) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") is pleased to announce that it has fully repaid the US$7.3 million non-convertible principal portion of the Second Amended and Restated Credit Agreement ("Second ARCA") with Nebari Natural Resources Credit Fund I LP ("Nebari"). All amounts in this news release are in United States dollars unless otherwise noted.

Following this repayment, the only remaining balance outstanding under the Second ARCA is the $5.25 million convertible principal amount, which Nebari retains the right to convert to equity under the previously announced terms and is less than the net proceeds expected through the monetization of the 48C tax credits.

"Reducing and ultimately eliminating debt has been a core objective of management," said Craig Hallworth, Senior Vice President and Chief Financial Officer of Gunnison Copper. "Fully repaying the non-convertible portion of the Nebari financing marks a major step forward in strengthening our balance sheet and capital structure. This achievement enhances our financial flexibility and advances our goal of fully retiring the remaining Nebari secured debt."

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; plans to fully retire the remaining Nebari debt; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, Nebari will convert the remaining principal amount of the Second ARCA, the availability of financing to continue as a going concern and implement the Company's operational plans, expectations regarding the receipt of 48C tax credits, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nebari not converting the remaining principal amount of the Second ARCA and the Company not having sufficient funds to repay such amount, the Company receives less 48C tax credits than expected, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276538

Phoenix, Arizona--(Newsfile Corp. - November 7, 2025) - It is with great sadness that Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") announces the sudden passing of Mr. Colin Kinley, Director of the Company. The Board and Company express their sincere condolences to Karen, Cooper, and Claire, their extended family and friends.

Colin joined Gunnison as a Director in 2010 and was Chair of the Compensation Committee. He was a well-respected member of the Board, bringing a wealth of knowledge and experience to Gunnison from his distinguished career that extended far beyond his technical expertise. He was an internationally respected explorationist within the natural resources sector, whose contributions to the Company, and industry, will be greatly missed.

"We are deeply saddened by Colin's sudden passing. He has been a valuable member of the Board since 2010, but more importantly he has been a friend for nearly 20 years. Our thoughts and condolences are with his family and friends; he will be deeply missed by all," said Mr. Stephen Twyerould, Chief Executive Officer & President of Gunnison Copper.

"Colin was a mining subject matter expert, a person of broad and valuable perspective and of sharp strategic instincts. But most importantly, he was a wonderful human being. His passing is a significant loss to our company and to us as friends," added Fred Duval, Chairman of the Board of Gunnison Copper.

Colin's seat on the Board will remain vacant until a new Director is proposed and confirmed at the next annual meeting of shareholders.

This news release is authorized for release by the Board of Directors of Gunnison Copper.

Contact Information

For more information on Gunnison, please visit our website at www.GunnisonCopper.com

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273576

Phoenix, Arizona--(Newsfile Corp. - October 31, 2025) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") is pleased to announce the closing of a second and final tranche of its previously announced non-brokered private placement (the "Offering") for aggregate gross proceeds of C$150,000.30 from the issuance of 333,334 Units (each a "Unit") to a single institutional investor. Each Unit, issued at a price of C$0.45 per Unit, consists of one common share of the Company (a "Common Share") and one-half of one common share purchase warrant (each whole warrant, a "Warrant"). Each Warrant entitles the holder to purchase one Common Share at a price of C$0.65 at any time on or before October 31, 2028. The securities issuable pursuant to the sale of the Units will be subject to a four-month hold period in Canada pursuant to applicable Canadian securities laws that expires on March 1, 2026. The Company raised aggregate gross proceeds of approximately C$13.3 million under the Offering. Please refer to the Company's press release dated October 30, 2025 for additional details.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the U.S. Securities Act or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3 billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E:

www.GunnisonCopper.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to the use of net proceeds from the Offering; the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; the continued funding of the stage 2 work program by Nuton; the details and expected results of the stage two work program; future production and production capacity from the Company's mineral projects; the results of the preliminary economic assessment on the Gunnison Project; and the exploration and development of the Company's mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company's operational plans, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.