GUNNISON PROJECT

The Gunnison Project is located about 65 miles east of Tucson, Arizona on the southeastern flank of the Little Dragoon Mountains in the Cochise Mining District. The property is within the copper porphyry belt of Arizona. The Gunnison Project hosts the Gunnison deposit and contains copper oxide and sulfide mineralization in potentially economic concentrations.

The Company completed an initial PEA in Q4 2024, outlining an open pit heap leach and SX/EW operation extending over 18 years and producing LME Grade A copper cathodes directly onsite. Updated PEA headlines were released in Q1 2026.

PROJECT HIGHLIGHTS

- Private and State land package and 100% ownership in Tier 1 jurisdiction

- Onsite power, rail and water in place

- Simple open pit heap-leach and SXEW operation

- Permitting framework is simple and streamlined with the State

NEXT STEPS

- Metallurgy and infill drilling

- Pre-Feasibility Study

- Definitive Feasibility Study

- Construction Decision

Highlights of the PEA (United States dollars)

- The Gunnison Project, a fully vertically integrated operation producing finished copper cathode on-site in Arizona for domestic U.S. supply chains, has an after-tax net present value (8%) of ~$2 billion and an internal rate of return (IRR) of 23% at a long-term copper price of $4.60/lb

- One of the most substantial open pit copper projects in the United States. The straightforward mine plan consists primarily of oxide copper mineralized material with a life of mine total processed of 541 million tons at 0.43% total copper grade, including 25 million tons at 0.85% total copper grade from the Strong & Harris satellite deposit

- Simplified and lower risk path to permitting; the Gunnison Project has current operating permits and there is a more streamlined amendment process to State and Local permits to proceed with open pit mining

- Significant economic impact to Cochise County, State of Arizona, and the United States nationally through creation of over 53,000 job years, $417 million in state and local county taxes, $951 million in federal taxes, and $14.6 billion in total economic output

- Average annual copper cathode production of 174 million pounds (“lbs”) (87 thousand tons) for the first 15 years; enough to potentially supply over 11% of the current United States domestic refined copper metal production from mineralized material1. Total copper produced 3.2 billion lbs over a 21 year mine life

- Cash costs of $1.69, Sustaining Cash Costs of $2.00, and All-In Sustaining Cash Costs of $2.06 per pound of copper produced are in the lower half of the cost curve for copper mines globally

Environmental advantages include lower water usage per pound of copper produced versus copper concentrate producers, up to 10% reduced energy consumption due to on-site clean energy production, and zero risk of environmental impacts from tailings dam failures as there are no tailings produced.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

TABLE OF KEY METRICS

Key Valuation Metrics at $4.60/lb Copper Price Base Case

| Valuation Metrics (Unlevered) | Unit | 2026 PEA |

| Net Present Value @ 8% (after-tax) | $ millions | 1,952 |

| Net Present Value @ 10% (after-tax) | $ millions | 1,419 |

| Internal Rate of Return (after-tax) | % | 22.7 |

| Payback Period | # years | 3.9 |

| EBITDA¹ (annual average Y1–Y15) | $ millions | 488 |

| EBITDA¹ (annual average Y1–Y21) | $ millions | 435 |

| Free Cash Flow¹ (annual average Y1–Y15) | $ millions | 366 |

| Free Cash Flow¹ (annual average Y1-Y21) | $ millions | 329 |

Notes:

1. Non-IFRS financial measure; see “Non-IFRS Financial Measures”.

Key Project Metrics

| Project Metrics | Unit | 2026 PEA |

| Construction Period | # months | 24 |

| Life of Mine | # years | 21 |

| Strip Ratio | Waste : Feed | 2.56 |

| Mineralized Material Mined | millions tons | 641 |

| High Purity Limestone Mined | millions tons | 133 |

| Alluvium-Gravel Waste Mined | millions tons | 1,007 |

| Hard-Rock Waste Mined | millions tons | 501 |

| Copper Grade of Material Placed on Leach Pad | % CuT | 0.43% |

| Annual Crusher Throughput (max) | millions tons | 40 |

| Copper Recovery – Global | % CuT | 68.0% |

| Oxide / Enriched Recoveries | % CuTSol | 90.2% |

| Primary Sulfide Recoveries (years 10 to 21) | % CuSu | 59.9% |

| Recovered Copper Cathode | millions lbs | 3,187 |

| Average Annual Copper Production (years 1-15) | millions lbs 000’s tons |

174 87 |

| Initial Capital (including contingency) | $ millions | 1,544 |

| Initial Capital Excluding Acid Plant | $ millions | 1,261 |

| Capital Intensity Excluding Acid Plant1 | $/ton Cu Capacity | 14,278 |

| Profitability Ratio | NPV8% / Initial Capex | 1.3 |

| Expansion Capital (including contingency)2 | $ millions | 682 |

| Sustaining Capital3 | $ millions | 613 |

| Cash Cost (C1)4 | $/lb Cu | 1.69 |

| Sustaining Cash Cost5 | $/lb Cu | 2.00 |

| All-In Sustaining Cash Cost6 | $/lb Cu | 2.06 |

Notes:

1. Capital intensity is calculated as initial capital excluding acid plant, $1,261M, divided by maximum annual copper cathode plant capacity 88.3 Ktons

2. Expansion capital is expenditures to either build new facilities, for example the cement plant built in years 4-5, or to expand the capacity of initial facilities, for example increased capacity of leach pad

3. Sustaining Capital are expenditures to maintain initial facilities. Includes $186 million in deferred stripping costs. Includes sustaining capital for both the copper plant and the cement plant

4. Cash Cost includes mine operating, crushing and leaching, process plant operating, and general and administrative costs ("G&A")

5. Sustaining Cost includes Cash Cost, Sustaining Capex, Deferred Stripping, and Royalties

6. All-In Sustaining Cost (AISC) includes Sustaining Cost, Property Taxes, Severance Taxes, and Closure Costs. It excludes expansion and initial capital and income taxes

The PEA was completed by M3 Engineering & Technology Corporation ("M3") of Tucson, AZ and is effective as of February 22, 2026. The Technical Report (the "Report") summarizing the results of the

PEA and prepared in accordance with National Instrument ("NI") 43-101, will be filed on SEDAR+ and GCC's website within 45 days of this news release.

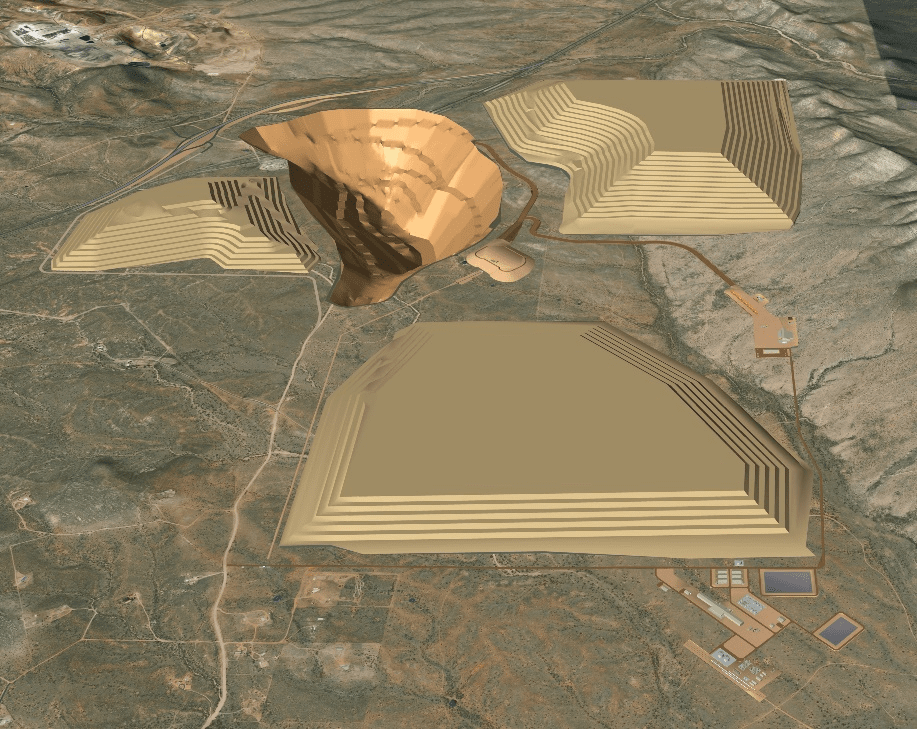

3D View of Gunnison Project Infrastructure