FINANCIAL ANALYSIS

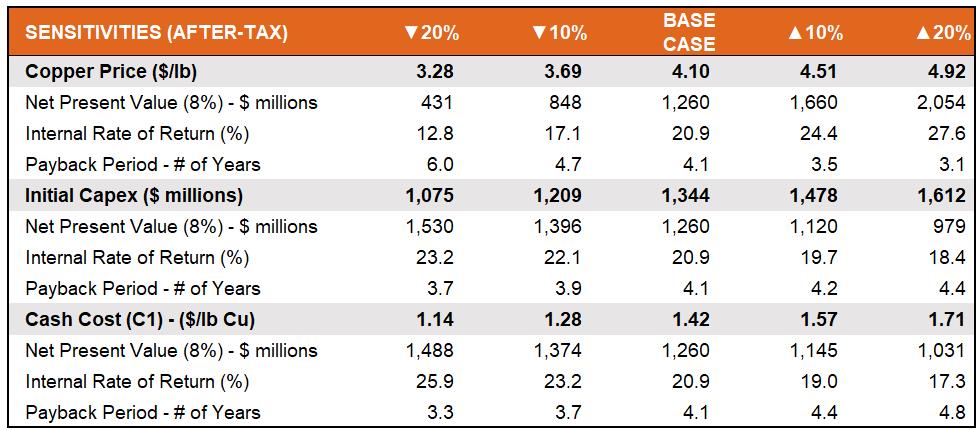

The PEA base case generates an after-tax NPV of approximately $1,260 million (at a cash flow discount of 8%) and an IRR of 20.9%.

The base case uses the following parameters over the 18-years of production:

- Copper selling price of $4.10/lb

- Total copper recovery of approximately 69%;

- LoM average of approximately 10.6 pounds of acid consumed for every pound of copper produced;

- Acid plant construction in year -1 with a price of sulfur of $110 per short ton delivered and a price of acid produced on site of 36 $/ton including power co-generation credits.

- Acid buying price of $150/ton for the few occasions acid is required above the acid plants capacity and an acid selling price of $130/ton if excess acid is produced in any year.

- Combined state and federal tax rate of [25.9]%;

Table of Capital Costs

The capital cost estimates for this PEA, shown in table below, were developed with a -25% to +30% accuracy. The Company has used an overall contingency of 20% in accordance with Association of the Advancement of Cost Engineering International (AACE) Class 5 estimate guidelines.

Total initial (pre-breakthrough) capital expenditures (including 20% contingency, EPCM, capital spares, owner’s costs, mobile equipment and freight) are estimated at $1,343 million for initial production of copper cathode. Mine costs includes pre-stripping and capitalized pre-operating mobile fleet lease costs. Total sustaining capital costs over the life of the mine are $876 million, which includes deferred stripping, leach pad expansion and mining equipment.

Facilities at the mine site will include one open pit, two waste stockpiles, primary crushing plant and conveying system, heap leach pad, Solvent Extraction-Electrowinning (SX-EW) process plant, sulfur burning sulfuric acid plant with cogeneration capability, technical and operational support offices, mine truck shop and maintenance buildings, refueling systems, electrical substation and distribution, water supply and distribution, warehousing and Union Pacific rail spur.

Table of Operating Costs

Mining operating cost estimates, prepared by Independent Mining Consultants (IMC), are based on an owner’s team managing mining activities, using an owner-operator model. Process operating cost estimates and G&A cost estimates were prepared by M3, as summarized in the table above (note numbers may not add due to rounding). Sequencing of operations and annual cash flows are detailed in Exhibit 1 and 2, at the end of this news release.

The operating site includes numerous infrastructure and location advantages including:

- Union Pacific rail line right next to the property with a 2 km rail spur envisioned.

- High voltage power lines with clean power from SSVEC.

- Close to local and regional labor pools of Benson, Willcox, and Tucson.

- Flat land conducive for development.

- Deposit is within an enclosed basin; therefore no 404 permit is required.

- No endangered flora or fauna on the property.

Table of Profitability Metrics

Table of Sensitivities

DCF Model Annual Cash Flows ($ millions)