TABLE OF KEY METRICS

| Valuation Metrics (Unlevered) | Unit | 2024 PEA $4.10/lb Cu |

| Net Present Value @ 8% (after-tax) | $ millions | 1,260 |

| Internal Rate of Return (after-tax) | % | 20.9 |

| Payback Period (after-tax) | # years | 4.1 |

| Project Metrics (Imperial unless stated otherwise) |

Unit | 2024 PEA $4.10/lb Cu |

| Construction Period – SXEW plant | # years | 2 |

| Life of Mine (“LoM”) | # years | 18 |

| Strip Ratio | Waste : Feed | 2.06/1 |

| LoM Mineralized Material Mined | ktons | 550,621 |

| LoM Alluvium-Gravel waste | ktons | 759,370 |

| LoM Hard-Rock waste1 | ktons | 375,227 |

| LoM Copper Grade | % CuT | 0.35 |

| LoM Average Annual Crusher Throughput | millions tons | 34.0 |

| LoM Recoveries | % CuT | 69.5 |

| LoM Oxide / Enriched Recoveries2 | % CuTSol | 90.0 |

| LoM Primary Sulfide Recoveries (years 8 to 18) | % CuSu | 60.0 |

| LoM Recovered Copper Cathode | millions lbs | 2,712 |

| Average Annual Copper Production (years 1-16) | millions lbs | 167.3 |

| Average Annual Copper Production (years 1-16) | 000’s tons | 83.7 |

| Initial Capital (including contingency)3 | $ millions | 1,343 |

| Sustaining Capital4 | $ millions | 876 |

| Cash Cost (C1)5 | $/lb Cu | 1.42 |

| Sustaining Cost6 | $/lb Cu | 1.94 |

| Average Annual EBITDA7 | $ millions | 419 |

| Average Annual Free Cash Flow8 | $ millions | 309 |

Notes:

1. Hard rock waste includes 85 million short tons of pure limestone, a highly marketable material.2. Excludes recovery of sulfides from conventional leaching. Some sulfides are expected to leach and provide up-side to recoveries and copper production.

3. Includes acid plant, leach pad, SX-EW, crushing facility, truck shop, mining pre-strip, highway move, owners’ costs and other minor infrastructure.

4. Sustaining Capital includes $346 million in deferred stripping costs

5. Cash Cost includes mine operating, crushing and leaching, process plant operating, and general and administrative costs (“G&A”).

6. Sustaining Cost includes Cash Cost, Sustaining Capex, Deferred Stripping, and Royalties.

7. EBITDA = Revenue – Cash Operating Expenses; Average annual of Y1 to Y16; Revenue includes sales of copper to U.S. based customers at Spot Price and sales of copper to Triple Flag at Stream Fixed Price (25% of spot)

8. Free Cash Flow = Operating Cash Flow (After Tax) – Capital Expenditures; Average annual of Y1 to Y16

Preliminary Economic Assessment Summary

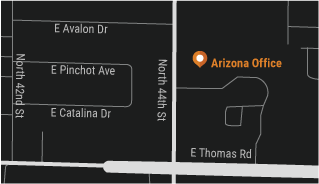

The Project is in Cochise County, Arizona, approximately 65 miles east of Tucson and is held or controlled 100% by GCC. The Gunnison deposit of the Gunnison Project was previously designed and developed as an in-situ recovery (“ISR”) copper operation. High copper prices, the advancement of sulfide leaching technologies, and the greater overall copper extraction afforded by open pit mining and heap leaching has prompted GCC to focus on the open pit alternative to ISR. Nevertheless, the optionality on the fully permitted ISR operations and well stimulation remains an asset to the Company and this optionality will be maintained. This includes maintaining full compliance with all regulatory and permit requirements including maintaining hydraulic control, pumping, monitoring and regulatory reporting.

The Gunnison Open Pit PEA plans to pre-strip alluvial overburden using leased owner-operated equipment. The deposit is a single large body allowing for more cost effective haulage costs, versus mining from numerous regional deposits. A primary gyratory crusher will be installed to crush to a P80 of 6 inches for leaching predominately oxide mineralized materials on the leach pad. A rail spur from the Union Pacific Southern Pacific (UPSP) will provide straightforward access and inexpensive transportation for incoming sulfur and outgoing copper cathodes. The sulfuric acid plant will produce acid with a net cost of approximately $36 a ton and 27 MW of clean energy.

GCC has a successful track record of permitting and community relations. This, along with the fact that the Gunnison open pit has no federal permitting nexus, on flat ground with no identified endangered or threatened species or habitat, and no historical, archaeological, or Native American artefacts, indicates the Company’s prior permitting track record can be maintained.